Legal

1. Regulatory

2. Terms & Conditions

3. Artorius Wealth Management Limited - Pillar III Disclosure

4. Best Execution Policy

1. Regulatory

Artorius Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. You can check this on the FCA Register at www.fca.org.uk/register (Firm Reference Number 677055). Artorius is a trading name of Artorius Wealth Management Limited.

This website is intended to be image advertising. It is not intended, and must not be construed as, providing regulated investment advice.

Complaints

If you have a complaint about the advice you receive from us or a product you bought through us, please contact our Compliance Team at: 2nd Floor, The Boardwalk, 21 Little Peter Street, Manchester M15 4PS. or email compliance@artorius.com

We are covered by the Financial Ombudsman Service (FOS). The FOS is available to settle certain complaints you make if they cannot be settled through our own complaints procedures. The contact details of the FOS are as follows: The Financial Ombudsman Service, Exchange Tower, Harbour Exchange, London E14 9SR, Website: www.financial-ombudsman.org, phone: (0)800 0 234 567.

2. Terms & Conditions

Please read these Terms carefully before viewing this Site. They set out the Terms and Conditions on which we make this Site and its content available to you.

By viewing or using this Site you agree that you have read and agree to be bound by these Terms (as amended and posted on this Site from time to time). You may use this Site only if you agree to be bound by these Terms.

This Site is directed at UK investors and is provided for information purposes only.

Nothing in these Terms shall restrict our duties to you under the Financial Services and Markets Act 2000.

Companies within the Artorius Group that do not carry out services subject to the Financial Services and Markets Act 2000 (the ‘Act’), either because they are not subject to the Act or are not performed in the UK, will not have the protections afforded by the Act.

1 - Definitions

In these Terms, unless the context otherwise requires, the following words have the following meanings: “Artorius ”, “we”, “us”, “our” is the provider of the artorius.com website. Artorius is the trading name of Artorius Wealth Investment Management Limited, a company registered in England & Wales, registered number 09285538, registered address 2nd Floor, 21 Little Peter Street, Manchester, M15 4PS. Authorised and regulated by the Financial Conduct Authority with register number 677055. “you”, “your” refers to you, the client, potential client or any other visitor to the site “FCA” refers to the Financial Conduct Authority. The FCA’s address is: 12 Endeavour Square, London E20 1JN. “Site” refers to all content hosted on this Site. “Terms” refers to these Terms & Conditions.

2 - Site Terms and Conditions

2.1 These Terms set out the basis on which you may use the Site, made available to you by Artorius.

No one else apart from us and you has any rights under, or may enforce, these Terms.

3 - Copyright

3.1 All copyright and other intellectual property rights in the information, design, text and graphics of the Site, and the selection or arrangement thereof, is owned by us or our licensors. All rights are reserved. You may store electronically (e.g. on a hard drive) and print in hard copy portions of the Site solely for your non-business related purpose of using the Site to seek information of the kind shown by the Site. Any other use of materials or content on the Site (including reproduction for purposes other than that noted above, amendment, updating, distribution or republication) without our prior written consent is prohibited. All product and firm names and logos mentioned on the Site are the trade marks, service marks or trade names of their respective owners, including us.

4 - Data Protection

4.1 Please see the Artorius [Privacy Policy] for information relating to the collection and use of your personal information.

5 - Cookies

5.1 Please refer to our Privacy Notice for information on cookies and their use on this Site.

6 - Limitation of Liability

6.1 We do not accept responsibility, nor will we be liable, for any failure of operation of the Site which arises as a result of:

a) errors in data transmission; or

b) machine or software malfunction; or

c) from your operating error (other than any such failure occurring as a result of our fraud, negligence or wilful default).

6.2 You acknowledge that access to this Site may be disrupted and that this does not amount to a breach of these Terms.

7 - Regulatory

7.1 Please refer to the Regulatory section of this website above.

8 - Complaints

8.1 Please refer to the Regulatory section of this website above.

9 - Risk Warning

9.1 Past performance is not a guide to future performance. The value of investments and any income from them may fall as well as rise and investors may get back less than the amount originally invested. Information on this site should not be relied upon when making financial or investment decisions.

10 - Legal

10.1 While we take every care to ensure that the standard of the Site and its content remains high and to maintain the continuity of the Site, you should be aware that the internet is not an absolutely stable medium and you agree that the Site and its content is provided to you “as is” and that errors, omissions, interruptions of service and delays may occur at any time. We do not accept any ongoing obligation or responsibility to operate the Site (or any part of it) or to provide the services offered on the Site.

10.2 We make no representations or warranties about the accuracy, completeness, freedom from viruses, availability, reliability or suitability for any purpose of the information and related content and graphics published on the Site (including all texts, advertisements, links or other items) which may contain technical inaccuracies and typographical errors.

10.3 You agree that you shall not attempt to interfere with the proper working of the Site and, in particular, you shall not attempt to circumvent security, tamper with, hack into, or otherwise disrupt any computer system, server, website, router or any other internet connected device relating to the Site.

10.4 Unless otherwise specified all content and materials published on the Site are presented solely for your private, personal and non-commercial use. You assume total responsibility and risk for your use of the Site and use of all information contained within it.

10.5 The information given on the Site is for information only and does not constitute investment, legal, accounting or tax advice, or a representation that any investment or service is suitable or appropriate to your individual circumstances. Please seek professional advice before making any investment decision.

10.6 Nothing on the Site should be construed as a solicitation or offer, or recommendation, to buy or sell securities or any other investment or banking product, or to provide any investment advice or service.

10.7 Any views expressed on the Site may no longer be current or may be changed without notice. Views may or may not have been acted on by Artorius.

11 - Social Media

11.1 Links to social media accounts from this Site and links from social media accounts to this Site presented by Twitter, Facebook and LinkedIn are owned by third-parties unaffiliated to us. Artorius is not responsible for those third-parties’ privacy, security, or terms of use policies that control these services, nor their content. Use of social media sites is at your own risk.

11.2 Artorius tweets and posts are for information purposes only.

12 - Termination of Site

12.1 We reserve the right to terminate this Site at any time.

13 - General

13.1 We reserve the right to assign, transfer, novate or subcontract any or all of our rights and obligations under these Terms to the extent that it is necessary for us to provide the service. Your consent will be required where any such assignment may adversely affect the service provided to you. If we fail to enforce a right under these Terms, that failure will not prevent us from enforcing other rights or the same type of right on a later occasion. These Terms set out the entire agreement between the parties. This clause shall not apply to any statement, representation, or warranty made fraudulently, or to any provision of these Terms which was induced by fraud.

13.2 You agree that we may at any time appoint agents, subcontract, or outsource some or all of the services and functionality comprised in this Site.

13.3 You are liable for any telephone or other communication charges and any charges made by your internet service provider or any third party incurred as a result of you using the Site.

13.4 If we fail to exercise a right and/or remedy under these Terms, such failure will not prevent us from exercising other rights or remedies or the same type of right or remedy on a later occasion.

13.5 If any provision of these Terms is held to be unlawful, invalid, or unenforceable, that provision shall be deemed severed and the validity and enforceability of the remaining provisions of these Terms shall not be affected.

13.6 From time to time, we may amend, vary, modify or update these Terms. We will notify you of any change no later than thirty, (30) days before such change takes effect.

13.7 These Terms & Conditions shall be governed by and construed in accordance with English law and the parties agree to submit to the exclusive jurisdiction of the English courts.

3. - Artorius Wealth Management Limited - Pillar III Disclosure

Pillar 3 and BIPRU Remuneration Code Disclosures

Artorius Wealth Management Limited (AWM)

Artorius Wealth Limited (Group or AWL)

Pillar 3 Disclosure

Background

This is the Pillar 3 disclosure made in accordance with the UK Financial Conduct Authority (FCA) Prudential Sourcebook for Banks, Building Societies and Investment Firms (‘BIPRU’).

The European Capital Requirements Directive (CRD) created a regulatory capital framework consisting of three ‘pillars’ namely; - Pillar 1 – which sets out the minimum capital requirements that firms are required to meet for; - Pillar 2 – which requires firms to take a view on whether additional capital should be held against capital risks not covered by Pillar 1; and - Pillar 3 - which requires firms to publish certain details of its risks, capital and risk management process.

Disclosure Policy

The rules in BIPRU 11 provide that the firm may omit one or more of the required disclosures if it believes that the information is immaterial. Materiality is based on the criteria that the omission or misstatement of material information would be likely to change or influence the assessment or decision of a user relying on that information for the purposes of making economic decisions. Where the firm considers a disclosure to be immaterial, this will be stated in the relevant section.

The firm is also permitted to omit one or more of the required disclosures where it believes that the information is regarded as proprietary or confidential. Proprietary information is that which, if it were shared, would undermine the firm’s competitive position. Information is considered to be confidential where there are obligations binding the firm to confidentiality with its clients and counterparties.

Where the firm has omitted information for any of the above reasons, a statement explaining this will be provided in the relevant section. Unless stated as otherwise, all figures contained in this disclosure are based on the firm’s audited annual reports for the year ending 30th April 2019

Frequency

These Pillar 3 Disclosures will be reviewed on an annual basis as a minimum. The disclosures will be published as soon as is practical following the finalisation of the firm’s Internal Capital Adequacy Assessment Process (ICAAP) and the publication of its annual reports.

Verification

The information contained in this disclosure has not been audited by our firm’s external auditors and does not constitute any form of financial statement.

Publication

Our firm’s Pillar 3 Disclosure report is published on our website.

Scope and application of Directive requirements

The disclosures in this document are made in respect of Artorius Wealth Management Limited (AWM) which provides financial advice and discretionary investment management services in the UK, and Artorius Wealth Limited (AWL) – which is the ultimate parent and head of the regulated group (Consolidated Group).

AWM is a BIPRU firm.

Risk management objectives and policies

Our risk management policy reflects the FCA requirement that we must manage a number of different categories of risk. These include: operational, interest rate, business, & credit risks.

Capital resources

Pillar 1 requirement

In accordance with GENPRU 2.1.45R (calculation of variable capital requirement for a BIPRU firm), our capital requirement has been determined as being our fixed overhead requirement and not the sum of our credit risk capital requirement and our market risk capital requirement.

The Pillar 1 capital requirement for Artorius Wealth Management Limited was £1,286,000 as at 30th April 2020.

The Pillar 1 capital requirement for Artorius Wealth Limited (Group) was £1,669,000 as at 30th April 2020.

Pillar 2

Our overall approach to assessing the adequacy of our internal capital is set out in our ICAAP. The ICAAP process involves separate consideration of risks to our capital combined with stress testing using scenario analysis. The level of capital required to cover risks is a function of impact and probability. We assess impact by modelling the changes in our income and expenses caused by various potential risks over a 1-year time horizon. Probability is assessed subjectively.

In addition, we have reviewed the outputs of our risk reviews to quantify any risks identified. This has identified a number of key business risks which we have classified against the risk categories contained in GENPRU 1.2.30R and reviewed the guidance in BIPRU 2.2.61-65.

Our Pillar 2 capital requirement, which is our own assessment of the minimum amount of capital that we believe is adequate against the risks identified, has been assessed as greater than our Pillar 1 requirement. There is a considerable surplus of reserves above the capital resource requirement deemed necessary to cover the risks identified.

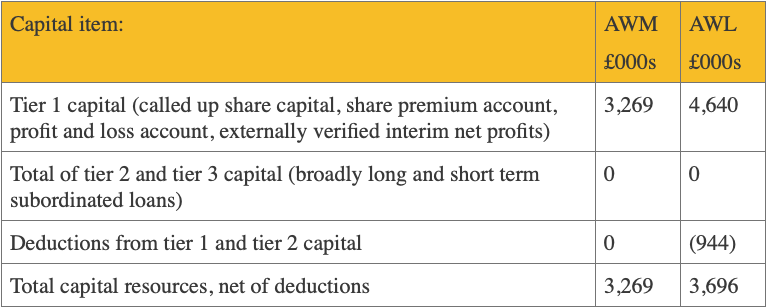

Regulatory capital

The main features of capital resources for regulatory purposes, as at 30th April 2020 are as follows:

The firm holds regulatory capital in accordance with the Capital Requirements Directive. All such capital is classified as Tier 1 capital and is therefore of the highest quality.

Deductions from tier 1 capital include intangible fixed assets, goodwill and illiquid assets.

Consolidation Waiver & Client Money

Artorius Wealth Management Limited (“AWM”) is a BIPRU Limited Licence firm with a Consolidation waiver, the direction is effective from 28/07/2017 and is valid until 31/12/2022.

The terms of the waiver allow AWL Group to run a capital deficit based on the initial excess as at 28/7/2017 and has been agreed with the FCA.

AWM may control and manage but cannot hold client money. AWM is classified as a flexible portfolio firm (a lower risk firm) in that it will be supervised through a combination of market based thematic work and programmes of communication, engagement and education.

Remuneration Code Disclosure

The firm is subject to the BIPRU Remuneration Code. This section provides further information on our remuneration policy.

BIPRU Remuneration Code Staff

We have identified, and maintain a record of, 'BIPRU Remuneration Code Staff' – i.e. staff to whom the BIPRU Remuneration Code applies. This includes senior management and members of staff whose actions may have a material impact on a firm's risk profile. All of our Code Staff fall into the "senior management" category of Code Staff (rather than the "risk taker" category) for the purposes of the BIPRU Remuneration Code.

Decision Making / Remuneration Committee

AWL has a Remuneration Committee. The remuneration committee is responsible for the Group’s remuneration policy including:

- Determining the framework and policy for remuneration and ensuring it does not encourage undue risk taking.

- Agreeing any major changes in remuneration structures.

- Reviewing the terms and conditions of any new incentive schemes and in particular, considering the appropriate targets for any performance related remuneration schemes.

- Considering and recommending the remuneration policy for the senior employees taking into account the appropriate mix of salary, discretionary bonus and share based remuneration.

- In determining remuneration arrangements, the Directors/Partners will give due regard to best practice and any relevant legal or regulatory requirements including the BIPRU Remuneration Code.

Link Between Pay & Performance

Competitive salaries form the basis of our firm’s remuneration package. In addition there is an element of variable pay for all staff which is based on firm wide and individual performance. Whilst most of the variable reward components are awarded to employees across the firm, the structure, balance and amounts may differ. Variable remuneration is considerably reduced where subdued or negative financial performance of the firm occurs.

When assessing individual performance we use a robust performance review process, with reviews including qualitative criteria and, in the case of investment managers, long-term investment results are a factor in the assessment process.

The FCA rules require certain firms to disclose aggregate information on remuneration in respect of its BIPRU Remuneration Code Staff broken down by business area, senior management and other Code Staff, including “risk takers”.

The firm has four Code Staff who received remuneration totalling £548,000. Details can be found in note 4 of the consolidated Group accounts of AWL

Risk management framework

The directors of AWM has prepared detailed procedures to cover the governance and regulatory aspects of its business. These include:

- A comprehensive governance structure designed to accommodate a rapidly expanding business

- A compliance manual summarising the regulatory processes and procedures

- A compliance monitoring programme which has been designed around risks considered to be relevant to the firm. This is updated on an on-going basis through a process taking input from the Risk and Governance committee. The compliance monitoring programme also highlights the processes in place which are designed to mitigate identified risks.

- A Risk and Governance Committee chaired by the COO which meets quarterly and whose remit is to assess and analyse all risks to the group and ensure remedial measures are put in place where required. The risks facing the firm are identified and considered both from the perspective of the likelihood of them occurring and from the perspective of their potential impact on the firm should they occur. This high-level risk register plan is reviewed at least quarterly but more frequently if needed.

- Investment in IT infrastructure to provide disaster recovery, efficient operations and high-quality investment research and monitoring, client risk profiling and a client database.

- A Client Experience Committee Group, chaired by the CEO whose remit is to review the advice policy of the business and outcomes of the policy for clients ensuring the clients’ interests are considered always with emphasis placed on treating the customers fairly. The mechanisms in place provide a decision-making forum where representatives of the firm can discuss advice propositions and technical points which may affect sales and operations with the aim of ensuring that clients receive the most appropriate advice and experience.

- An Investment Committee, chaired by the CEO whose remit is to review and assess new market developments / trends that may affect our investment strategy. The committee also ensures that our current house view and investment strategies remain fit for purpose identifying any changes which may be needed. An additional important role of the committee is to accurately measure the performance of client portfolios ensuring they remain within their risk tolerances.

- A Remuneration Committee chaired by the CEO whose remit is to review, assess and approve remuneration structures and any incentive schemes having due regard to best practice and relevant legal and regulatory requirements.

The group employs a Group Compliance Officer and a Finance Team, providing required in- house risk management on a daily basis.

Business planning

The firm has a comprehensive business plan which focuses on the delivery of quality services to our clients by means of advisory and discretionary services. The plan also covers the firm’s revenue and cost budgets associated with developing its position in the marketplace.

The business plan is reviewed annually by the AWL and AWM board , whilst the costs and revenues associated with developing the firm’s position in the marketplace will be reviewed monthly as part of the firm’s financial reporting process. The implications of the firm’s business plan and the consequences of any review are fed into the firm’s ICAAP & Pillar 3 process.

Capital management

AWM is deemed to be a BIPRU firm. The directors have assessed under the capital requirement of BIPRU firms, that the three months fixed overheads capital requirement will be significantly in excess of the base requirement of €50k.

The Finance Team prepares monthly management accounts, including a Balance Sheet, Profit & Loss Account plus confirmation of adequate regulatory capital & liquidity. The capital requirement is currently met using cash reserves. The directors monitor the capital positions on a monthly basis. Monthly management accounts are drawn up by the Finance Team and approved by the directors.

Liquidity management

The firm’s liquidity tolerance The Firm has a conservative approach to liquidity management, holding cash to the equivalent of at least three months’ fixed costs with a 20% buffer, as measured under ICAAP, in immediate access bank accounts.

Management of liquidity tolerance The firm produces a profit and loss account & balance sheet on a monthly basis, and a monthly liquidity multiple which is signed off by the senior manager responsible. The firm re-calculates on a quarterly basis its three-month fixed cost cash flow requirement, and the firm’s three-month capital requirement is noted on the firm’s monthly management accounts balance sheet.

Liquidity sign off The directors discuss and sign off the firm’s management accounts on a monthly basis.

Material Risks

Risk Management Process

The firm has a formal process for the consideration and identification of risk which is considered by the firm’s Compliance.

The firm’s risk management process consists of the following steps.

a) Compliance monitor the risks faced by the firm on an ongoing basis and will recommend any changes that should be made to the firm’s compliance monitoring programme, risk register, systems and controls and other means of managing or mitigating risk. These recommendations are made to the Risk & Governance committee, which will determine the acceptance or otherwise of these controls and recommendations. b) Annually, the firm will arrange for the compliance monitoring programme to be formally reviewed by an external source. The next review is in November and will be conducted by threesixty Services. The firms risk register is reviewed quarterly by the R&G Committee. c) Risk management and control is the responsibility of all staff, escalating ultimately to the directors. Compliance will be expected to ensure that specific actions which have been agreed to manage and mitigate risk are implemented, under supervision by the directors. d) Wherever possible, risk management processes will be embedded into the day to day management of the firm.

The firm has identified some of the material risks which will have a significant effect, now and, or in the future on the firm’s ability to achieve its business goals and objectives. These risks are listed below however, please read this in conjunction with the risk register.

Competition risk

AWM operates in a competitive environment and faces the risk of client loss from a failure to respond to market changes. AWM seeks to minimise this risk through its investment in its staff. AWM regularly reviews and benchmarks its remuneration packages in order to retain and recruit high quality staff.

4. Best Execution Policy

Overview

It’s in the interests of our clients and our firm that we obtain the best possible result when placing orders for execution on behalf of our clients, with third parties, such as platforms, fund managers or stockbrokers. We’re required to take all sufficient steps to provide best execution when carrying out such transactions and, on your request, to provide you with a copy of the policy that we have adopted to achieve that objective.

This best execution policy applies to orders in investments such as funds and other securities. You should read this policy in conjunction with your client agreement.

Execution venues and third parties

An execution venue is effectively a trading venue such as a regulated stock market where investment transactions are executed. Our firm doesn’t execute orders or deals directly with execution venues.

Instead, we’ll place orders on behalf of our clients with appropriate third parties as explained below:

Investments on a platform or with a custodian bank: for investments held on our preferred platform(s) (an online investment administration service) or custodian bank, client orders will be placed directly with the relevant platform. These are Credit Suisse & Seven Investment Management in the UK and UBS, Lombard Odier, Julius Baer and Credit Suisse in Switzerland.

Investments not on a platform: for investments held directly with individual fund managers, client orders will be placed directly with the relevant fund manager for the particular investment.

Stocks and shares: we use our client’s custodian or platform, as above.

We’ll regularly assess the third parties available to us to identify those that will enable us, on a consistent basis, to obtain the best possible result when arranging the execution of your orders. The above list will then be updated, where necessary, following such assessment.

The third parties have responsibilities in relation to best execution and client order handling themselves. We’ll also undertake periodic monitoring to ensure that they’re meeting the relevant requirements.

Execution Factors

When transmitting orders to a third party, we’ll make every effort to ensure the best possible result for our clients taking into account the following factors: - Price - Cost - Speed - Likelihood of execution and settlement - Size - Nature of the order - Any other considerations relevant to the execution of the order For retail clients, the price and cost of execution of the order will normally be the most important aspect in obtaining the best possible result. We’ll therefore assume that this is the most important outcome for your transaction unless you tell us otherwise. Client specific instructions If you’ve given instructions that price is not the most important factor in executing your instructions, we’ll make every effort to comply with your instructions but cannot guarantee this. This may be due to either the nature of the order, or the type of investment you wish to trade in. We’ll make all decisions as to where the orders are placed and won’t usually accept specific instructions from clients regarding which third parties to use, such as a particular broker. If we do accept any client specific instructions you should be aware that this may prevent us from following the processes set out in this policy which have been designed to obtain the best possible results for the execution of those orders in respect of the elements covered by those specific instructions.

Charges

It’s our policy that commission and charging structures won’t influence either the selection of third parties to which we place client orders, or the order flow that follows as a result of the execution process. We’ll therefore not discriminate between the third parties used to arrange execution of your orders.

Monitoring and Review of our Execution Policy

We’ll regularly monitor the effectiveness of our best execution policy to identify and, where appropriate, correct any deficiencies. In particular, this will cover the third parties to which we transmit client orders in terms of their quality of execution. This review will be carried out regularly or whenever a material change occurs that affects our ability to continue to obtain the best possible result for our clients.

Staff understanding

All relevant staff are made aware of this policy to highlight and emphasise the importance of best execution.